A phone call is necessary in this situation because of the private and confidential nature of the 1095B form. If you have had an address change in 2019 or 2020, please call customer care to request a printed copy of the 1095B. If you have any questions about your Form 1095-B, contact UnitedHealthcare by calling the number on your ID card or other member materials.

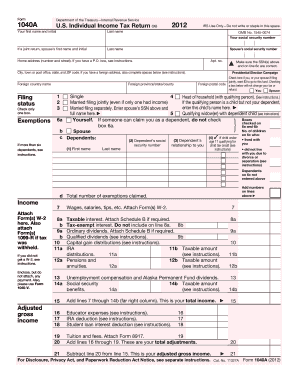

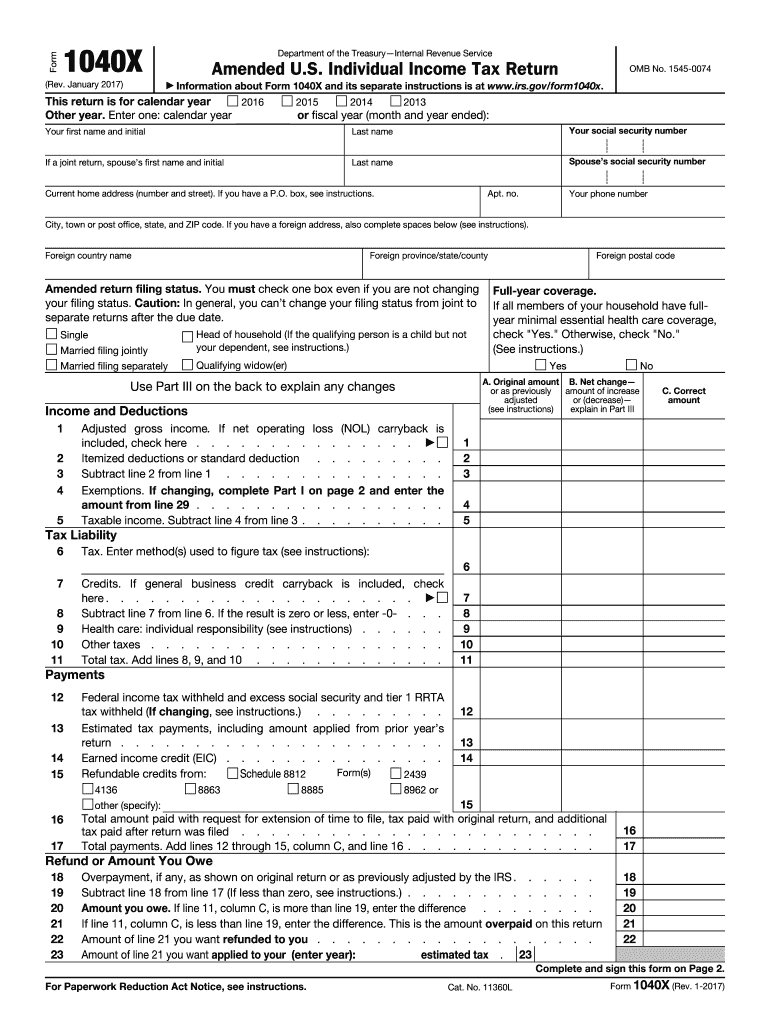

Members can view and/or download and print a copy of the form at their convenience, if desired.Īdditionally, a request for a paper form can be made in one of the following ways: How to find or request your Form 1095-Bįorm 1095-B will still be produced for all UnitedHealthcare fully insured members and will continue to be made available on member websites, no later than the annual deadline set by the IRS. Indiana Full-Year Residents Federal forms such as Form 1040 and W-4 can be found on the IRS website. Not seeing the form you need Check Miscellaneous Forms. Prior year tax forms can be found in the Indiana State Prior Year Tax Forms webpage. Members living in states with laws that require reporting of health coverage will continue to receive a paper copy of the Form 1095-B for state filing tax purposes. To download a form, click on the form name in the left column in the tables below. Therefore, individuals no longer need the information on the Form 1095-B to file a federal income tax return. Under new law that became effective beginning with the 2019 tax year, the IRS penalty for not having health coverage was reduced to zero. The forms for those taxes are the same in each category.Most fully insured UnitedHealthcare members will no longer automatically receive a paper copy of the Form 1095-B due to a change in the tax law. Some taxes are listed as both income taxes and business taxes. You can also update your information online, but must create a username and password first. If you need to update your address, close a tax account, or request payment coupons, you can use the change form. Forms for those taxes are not included on this page. You can choose to pay any City tax online using the Philadelphia Tax Center, but some taxes must be paid online. The above forms arent available on this website for downloading. Forms include supplementary schedules & worksheets going back to 2009. With the Tax Tools menu open, you can then: Preview your entire return: Select Print Center and then Print, save or preview this years return (you may be asked to register or pay first) View only your 1040 form: Select Tools. VDP01 Voluntary Disclosure Application Form WT002 Return for Withholding Tax on Interest. You can use these forms and instructions to file City tax returns.

0 kommentar(er)

0 kommentar(er)